…Says nothing wrong with budget deficits

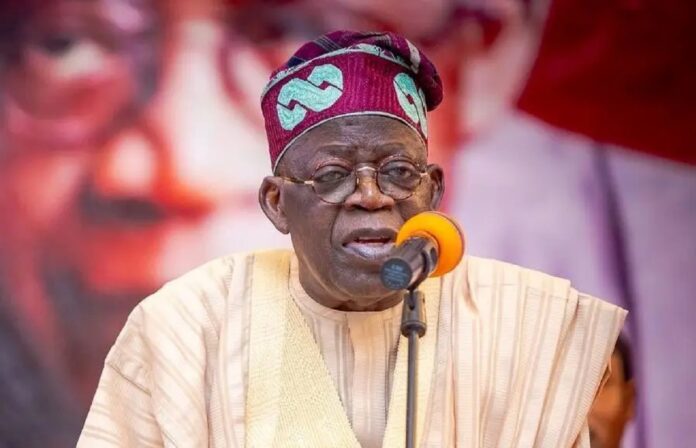

Presidential Candidate of the All Progressives Congress Asiwaju Bola Ahmed Tinubu on Friday in Lagos unfolded his comprehensive economic plan before the organised private sector under the aegis of the Nigerian Economic Summit Group.

The interaction saw Tinubu itemise his administration’s path to economic recovery if elected in next month’s presidential election. He noted that before economic recovery could be achieved the nation must be secured, stating that, “no nation can flourish with terrorists and kidnappers in their midst.”

The dialogue again gave him an opportunity to emphasise the importance of the private sector and his administration’s readiness to partner them. He said, “My core belief is that the private sector must be the prime driver of economic progress.

However, the government establishes the framework within which the private sector must operate. If that framework is sound, the private sector will flourish. If the framework is frail or incomplete, then the private sector will struggle.”

He added that his administration would immediately after getting to office, urgently address fiscal, monetary, and trade reforms to effectively increase domestic production, thus serving to curb imported inflation, and to ensure better macro-economic stability by accelerating inclusive growth and job creation across Nigeria.

To achieve this, he listed principles that will guide their plans and policies. These principles include how to tackle inflation, petrol subsidy and monetary policy.

“I do not hold to the mainstream view that all forms of inflation are best tackled by interest rate hikes and shrinking the economy. Supply induced inflation does not lend itself to this harsh medicine, just as one does not cure a headache by plucking out one’s eye.

“I do not embrace the conventional wisdom that fiscal deficits by the national government are inherently bad. All governments, especially in this era of fiat currency, run secular budget deficits. This is an inherent part of modern governance. The most powerful and wealthiest governments run deficits, as do the poorest nations.

“A budget deficit is not necessarily bad. Look at the Japanese example with high government borrowing and low inflation. The real issue is whether deficit spending is productive or not.

Unproductive deficit spending is a compound negative. Especially if backed by excessive borrowing of foreign currency. This is not classroom economics but it is the lesson of the real economic history of nations.