By Hafsat Bakari

It is an honour to welcome all of you this morning to the first of what will be a regular series of dialogues between the Nigerian Financial Intelligence Unit and the competent authorities which you represent. This forum is borne out of a programme of strategic external engagement exercises we held earlier this year, as a means of gathering feedback on our performance. Across all the discussions we had with the Heads of the Agencies that are responsible for acting on the intelligence we provide, there was an appreciation of the value of the NFIU but also constructive criticism on areas we can improve.

It is well known that NFIU plays a very specific role within Nigeria’s security architecture. We do not investigate, we do not arrest and we do not prosecute. This allows us to focus particularly on our areas of core competence, which is receiving financial reports, analysing these reports to follow the money trail and providing you with our best understanding of the underlying criminal offences.

We also recognise that the modern crime environment particularly for the most serious offences is dynamic, fast-paced and often trans-national in nature. All of us also understand that for the vast majority of criminal offences, whether fraud, corruption or indeed terrorism, money is at the centre. Whether as a proceed of the act or as an enabler of the act.

Consequently, the only truly sustainable approach to crime prevention and disruption is identifying where these funds are and denying criminal actors access to them. We canonly achieve this if we have efficient and effective systems for conducting financial analysis and this Ladies and Gentlemen is the ultimate goal of the NFIU, to provide you in a timely manner, with credible, reliable and actionable financial intelligence.

However, returning to the dynamism of the criminal environment, there are several challenges which we must overcome if we are to produce this intelligence on a consistent basis. The volume of data that we receive and analyse is huge and will only continue to grow in the future as financial inclusion, decentralised finance and other emerging technologies shift transactions into the electronic space.

In 2023, the NFIU received over 60,000 Suspicious Transaction and Activity Reports, and over 15 million Currency Transaction Reports. Aligned to this is the use of new technologies which provide a layer of anonymity and complexity to transactions. From crypto-currency to agency banking, the link between the owner of the funds and the transaction itself is becoming more opaque.

This also ties to our third challenge, the increasingly transparent borders. Not in the

physical sense, but the electronic sense. Funds, money and transactions move rapidly across financial institutions, digital platforms and through underground banking systems.

However, our systems for international cooperation are still subject to the frictions put in place by national borders, information silos and non-cooperative jurisdictions.

To address these challenges, it is clear that we need to collectively up our game. To this end, I wish to propose a number of strategic priorities which should feed into the discussion today:

1. First, there needs to be concerted effort to improve the utilisation of technology tools across all the competent authorities. While I recognise that many agencies have made significant investments in procuring and establishing databases and other platforms, interconnectivity remains a challenge. To become more effective, we should ensure that all our databases and platforms are built to common standards and shared protocols which will allow for seamless integration and connectivity. We should also prioritise the integration of the various identity databases to enable us to integrate financial flows with communication data and case records.

Building these integrated systems and deploying new tools, utilising artificial intelligence and machine learning has the potential to transform the speed at which we can intercept and disrupt criminal networks.

We should also develop a national financial crimes database which holds information on investigations, prosecutions, convictions as well as sentences and proceeds of crime. This will enable us to make better policy decisions to respond to changes in crime typologies.

2. Second, we should also encourage the creation of fusion cells and joint investigation teams targeting the highest risk offences and the most serious crime networks. With the benefit of sitting in the NFIU and having an overview of the various requests for information we receive from different authorities, it is clear that there are often multiple agencies targeting and investigating the same

individuals and networks. This can often lead to a duplication of effort and inefficient use of resources.

*By working together, we can utilise the comparative advantage of each authority in a more efficient manner.

Finally, we should prioritise international cooperation. As I noted earlier, many of the crimes that we combat are trans-national in nature. It may be that the commission of the act happens in other jurisdictions, the perpetrators are not within our borders, or the proceeds are transferred as illicit financial flows.

Through networks such as the Egmont Group of FIUs, INTERPOL and other informal channels information is available which can support investigative activities and point to assets which can be repatriated. These informal networks provide the basis for activating formal cooperation measures such as Mutual Legal Assistance requests through the Central Authority Unit which provide evidence for effective prosecution and asset recovery.

Distinguished guests, ladies and gentlemen, Nigeria has been on the list of jurisdictions under monitoring by the Financial Action Task Force (FATF) since February 2023. This listing was triggered by an assessment which found that our country has significant deficiencies in its laws, institutions and systems to combat money laundering, terrorist financing and financing of proliferation of weapons of mass destruction. Many of these deficiencies arise from some of the challenges I have mentioned earlier.

While we have made significant progress in the past 19 months to implement an Action Plan to address these deficiencies, two strategic items remain, which will determine whether we exit the list in May 2025 or risk being escalated to the blacklist. If we are escalated, the financial and economic impact of Nigeria has the potential to be very damaging.

In order for us to avoid this prospect we need to ensure

i. that our investigation and prosecution of money laundering linked to fraud,

drug trafficking and corruption is sustained

ii. continue to make progress in the investigation and prosecution of the financing of terrorism

Both items can be addressed through a focus on the three priorities I identified of effective use of technology, domestic coordination and international cooperation.

I wished to highlight the issue of the grey-list before I concluded my speech because of the international attention and focus on Nigeria. It is a fact that we are perceived as a high-risk jurisdiction for a number of very serious crimes and some of this perception is due to the message we send out. It is important that we develop a counter-narrative which promotes the excellent work and results that all our law enforcement agencies and security services are delivering.

From our efforts to combat terrorism and banditry to the disruption of drug trafficking networks and the fight against serious organised criminal group, we are making progress and we must not be more vocal about these successes.

Let me conclude by reaffirming the commitment of the NFIU to supporting all of the agencies in this room. To providing you with the credible and timely intelligence you need to carry out your mandates. And to working with all of you in the spirit of

cooperation, coordination and collaboration.

I would like to thank you all for your presence today and for your willingness to also support us by providing your honest feedback and valuable insight and input into how we can work together for the betterment of our country and for the safety and security of our citizens. I wish you all a good morning and productive deliberations over the rest of the day.

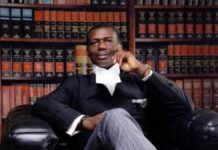

Bakari, the Director and Chief Executive Officer (CEO) of the Nigerian Financial Intelligence Unit (NFIU), delivered this Welcome Remarks at the NFIU-Law Enforcement Agencies Summit in Abuja … on Wednesday, October 16, 2024.