In a sweeping clampdown that upends long-standing practices across federal institutions, the Federal Government has outlawed the collection of physical cash by its ministries, departments and agencies (MDAs), declaring a final end to counter-cash transactions that have persistently undermined its electronic payment reforms.

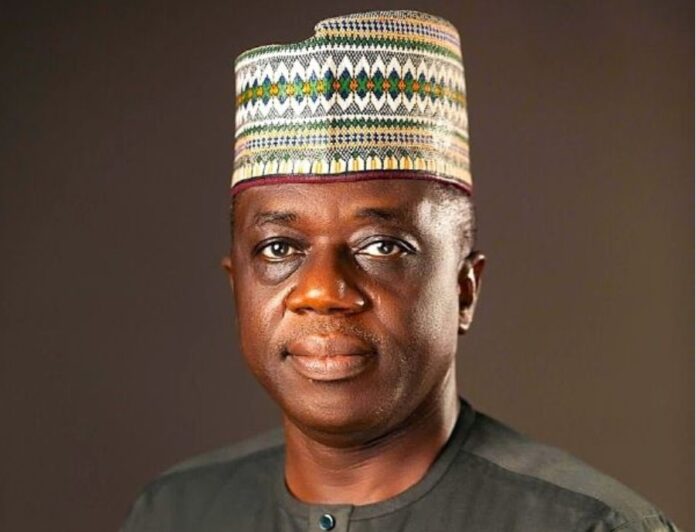

The ban, which reverses years of leniency toward MDAs that continued to handle cash despite repeated warnings, was issued through four treasury circulars dated November 24 and signed by the Accountant-General of the Federation (OAGF), Shamsudeen Ogunjimi.

Rather than the old practice where MDAs mixed digital payments with physical receipts, the accountant-general said the government would now operate strictly on electronic channels, insisting that continuous violation of previous directives had weakened both the treasury single account (TSA) and the federal electronic collection system.

Ogunjimi, visibly dissatisfied with MDAs’ disregard for earlier guidelines, pointed out that the persistent use of cash violated established financial regulations.

The circular reads in part, “In view of the above, it is hereby directed that collections and/or acceptance of physical cash (in Naira or other currencies) for all revenues due to Federal Government is strictly prohibited.

“All revenue collections, for and on behalf of the Federal Government must be made via electronic processing.”

To reverse the trend, he ordered MDAs to embark on an aggressive sensitisation of staff and the public, and to place notices at all collection centres clearly stating: no physical cash receipt/no cash payment.

“Hence, all payments to government must be made via electronic channels duly approved by the OAGF and integrated to the appropriate TSA accounts,” Ogunjimi said.

For agencies still relying on cash desks, the grace period is brief. MDAs and federal government-owned enterprises (FGOEs) have been handed a 45-day deadline to install POS machines or any other approved electronic collection devices at every revenue point nationwide.

The OAGF warned accounting officers that they will be personally liable for any violation traceable to their MDAs, stressing that the era of hiding behind institutional bureaucracy was over.

His concerns extended beyond cash counters. The accountant-general faulted the growing habit of MDAs deploying private payment portals without approval and permitting service providers to deduct charges before remitting funds. He described the practice as a dangerous breach that opens fresh channels for revenue leakage and violates extant financial laws.

To halt the leakages, MDAs and FGOEs have been directed to immediately stop all deductions made through private portals, remit gross collections into TSA accounts and tidy up their platforms and service-provider relationships with the OAGF before December 31, 2025.

“Consequently, MDAs/FOEs found non-compliant shall have all their access on GIFMIS and TSA Sub-accounts disabled; and in the same vein, TSA/GIFMIS Department has been mandated to ensure full compliance,” the AGF said.

In what marks a major turn in government documentation, Ogunjimi also unveiled a new mandatory federal treasury e-receipt (FTe-R), which from January 1, 2026, will become the only accepted proof of payment of government revenue. The e-receipt, according to him, will be generated centrally on the Revenue Optimisation (RevOP) platform and transmitted electronically to payers.

He said the innovation is intended to create full transparency across the TSA chain and eliminate manual receipts that previously blurred audit trails.

The fourth circular introduced the RevOP and Assurance Platform as the federal government’s unified architecture for real-time revenue monitoring, automated billing, and reconciliation. The platform will link directly with TSA, the Government Integrated Financial Management Information System (GIFMIS), the Central Bank of Nigeria (CBN), Nigeria Inter-Bank Settlement System Plc (NIBSS), the Federal Inland Revenue Service (FIRS) and commercial banks.

With these measures, the accountant-general signalled the start of a tighter, technology-driven fiscal regime—one that shuts the door on cash handling and attempts to plug every leakage in the government revenue pipeline.