Guaranty Trust Holding Company Plc has announced the successful recapitalisation of its wholly owned banking subsidiary, Guaranty Trust Bank Limited to N504 billion through a rights issue subscription for 6,994,050,290 ordinary shares a total value of N365.850 billion.

The Capital Injection, the group said in a statement, increases GTBank’s paid-up share capital from N138.186 billion to N504.037 billion, has enabled the bank comply with the new minimum capital requirement for commercial banks with international authorisation stipulated by the CBN.

The additional equity capital, the group said, will be deployed by GTBank primarily for branch network expansion and asset growth (loans, advances, and investment securities portfolio), fortification of its information technology infrastructure and to leverage emerging opportunities in Nigeria and the operating environments where it maintains banking presence.

The Capital Injection was funded by the two-phased equity capital raising programme recently undertaken and concluded by GTCO Plc. This included an international fully marketed offering on the London Stock Exchange (LSE) that secured $105 million from high-quality, long-term institutional investors in exchange for 2.29 billion new ordinary shares, making GTCO Plc the first financial services institution in West Africa to dual list on both the NGX and LSE.

Launched in July 2024, GTCO’s equity capital programme began with a public offering to Nigerians that raised N209.41 billion from 130,617 valid applications for 4.7 billion ordinary shares, fully allotted and evenly split between retail and institutional investors.

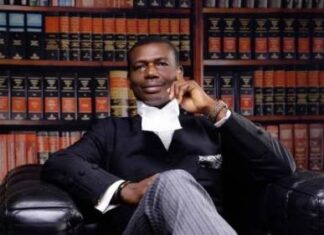

Commenting on the recapitalisation, Segun Agbaje, Group Chief Executive Officer of GTCO Plc, said “the successful recapitalisation of our flagship banking subsidiary, Guaranty Trust Bank Limited, marks a pivotal step in strengthening the foundation of our Group. With significant new capital secured and the CBN’s recapitalisation directive for Guaranty Trust Bank now fulfilled, we are focused on deepening innovation and service excellence, delivering improved performance, and expanding our footprint across high-growth markets, while upholding the industry-leading standards that define the GTCO brand.”

Following the Capital Injection, the company continues to hold 100 percent of the entire issued and paid-up share capital of the bank. None of the Directors of the Company has any interest, direct or indirect, in the bank.