Nigeria Deposit Insurance Corporation (NDIC) has paid a cumulative insured sum of N1.393 billion to 36,163 depositors of 110 closed Micro Finance Banks (MFBs) and three Primary Mortgage Banks (PMBs) in liquidation as at September this year.

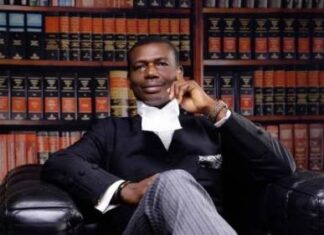

Managing Director/ Chief Executive Officer of NDIC, Bello Hassan who disclosed this in Lagos during NDIC special day at the Lagos State Trade fair said the recent revocation of licenses of some Microfinance Banks and Primary Mortgage Banks by the Central Bank of Nigeria (CBN), the NDIC has commenced the liquidation of these banks and began disbursing insured sums to depositors within a record time of three days of the banks’ closure.

He said the payments of the statutory insured sums are still ongoing, and depositors with funds exceeding the insured limit will receive liquidation dividends after the recovery of debts and the sale of the closed banks’ physical assets.

He said in another development the Corporation is currently in the process of verifying and paying liquidation dividends to depositors and stakeholders of 20 banks in liquidation including Allied Bank, Peak Merchant Bank, Commerce Bank, Continental Merchant Bank, Financial Merchant Bank, Fortune Bank, Gulf Bank, Hallmark Bank, Icon Merchant Bank, Liberty Bank, Nigeria Merchant Bank, North South Bank, Premier Commercial Bank, Prime Merchant Bank.

He told the gathering that public policy objective of the Deposit Insurance Scheme (DIS) in Nigeria is to protect the interests of small depositors by providing a mechanism for reimbursement in the event of imminent or actual bank failures amongst others.

This according to him was done while entrenching safe and sound banking practices, contributing to an orderly payments system, and enhancing fair competition in the banking sector.

He said the DIS designed as a “risk minimizer” with core functions of deposit guarantee, bank supervision, distress resolution, and liquidation of failed insured deposit-taking financial institutions.